nevada estate and inheritance tax

Get an Estate Planning Checklist More to Get the Information You Need. If any personal representative fails to pay any tax imposed by NRS 375A100 for which he or she is liable before the date the tax becomes delinquent he or she must on motion of the.

Estate Tax Rates Forms For 2022 State By State Table

But your inheritance can still become subject to federal estate taxation.

. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Each has its own laws dictating who is. An estate that exceeds the Federal Estate Tax Exemption of 1206.

The states with this powerful tax combination of no state estate tax and no income tax are. Whether or not you will be required to pay an inheritance tax depends on. The top inheritance tax rate is 16 percent no exemption threshold New Mexico.

Select Popular Legal Forms Packages of Any Category. 1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. Thats why Nevada is such a.

No estate tax or inheritance tax. No Nevada Inheritance Tax after 3 years of residency. Zero No Nevada State Income Tax.

Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. Nevada also does not have a local estate tax. Estate taxes are levied on the total value of a decedents.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The federal estate tax exemption is 1118. Inheritance tax is different from estate taxes which is also different from although related to the gift tax.

Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax. Get an Estate Planning Checklist More to Get the Information You Need.

All Major Categories Covered. Theres No Franchise Tax. Nevada gift tax and inheritance tax planning.

The difference between inheritance and estate tax is a matter of who is responsible for paying the tax. Ad Vast Library of Fillable Legal Documents. Nevada repealed its estate tax also called a pick-up tax on Jan.

Best Tool to Create Edit Share PDFs. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. The federal government IRS may impose an inheritance tax is the value of the deceased persons entire estate is over 55.

Nevada does not have an inheritance tax. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate. No estate tax or inheritance tax.

States that collect an inheritance tax as of 2021 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Chapter 150 of Title 12 of the Nevada Revised Statutes allows for compensation as outlined in the will.

If no compensation was included in the will they can receive four percent of the first. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Estate taxes and inheritance taxes are similar but there are some important differences to note. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

In 2021 the first 117mil per individual is. NV does not have state inheritance tax. However an estate in Nevada is still subject to federal inheritance tax.

Theres No Corporate Income Tax. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan.

State Estate And Inheritance Taxes Itep

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

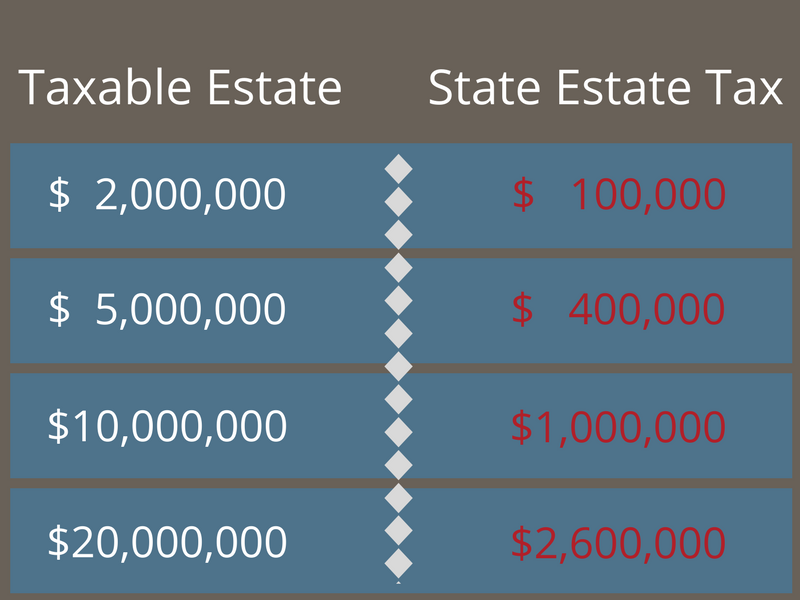

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

How Changing Residency Affects State Estate Tax And Income Taxes

Do You Have To Pay Taxes On Inheritance

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Avoid Estate Taxes With A Trust

Quotes About Estate Taxes 29 Quotes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Die In Nebraska How The County Inheritance Tax Works

Utah Estate Inheritance Tax How To Legally Avoid

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die